Smallholder farmers lack insurance protection

33%

of the world’s food supply is produced by smallholder farmers, yet they remain especially vulnerable

90%

of smallholder farmers still remain uninsured, leaving them unprotected from financial losses

100%

of crop insurance initiatives face barriers with affordability, accessibility, and equitable payouts

and, if we do nothing?

Social

Farmers continue to remain dependent on governmental subsidies and, 70M people potentially facing increased hunger and poverty by 2050

Environmental

A 2°C rise in global temperatures within the next few decades, with agriculture contributing 25% of greenhouse gas emissions by 2030

Economic

Climate-related agricultural losses reaching $500B annually by 2050, and extreme weather events causing $1.5T in economic losses by 2030

Our solution: Carbon Credit-Linked Insurance (CCLI)

Fully Embedded

Integrated with farmers’ carbon credit projects through project developers (PDs) and aggregator platforms to simplify insurance acquisition

Accessible

Leverages carbon reduction practices such as Alternate Wet and Drying (AWD) techniques, with generated carbon credits subsidizing insurance premiums

Parametric MRV

Automated claims enabled by Monitoring, Reporting and Validation (MRV) data, ensuring transparent, prompt and reliable parametric insurance

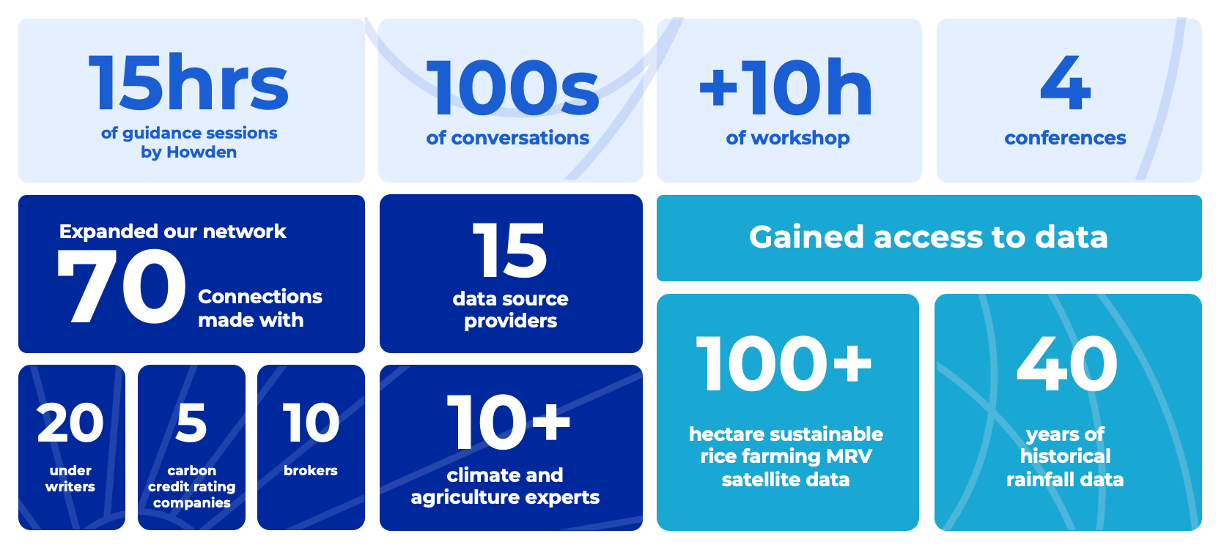

Our journey with Lloyd’s Lab

Key milestones and outcomes

Our ESG Mission

Cost-Efficient Global Distribution Solutions

- Reduce transaction cost

- Reshaping insurance accessibility, affordability and profitability

Revolutionize Crop Insurance

- Facilitate carbon credit access and partnerships

- Enable sustainable farming and finance tech-driven crop insurance

Reach New Customer Segments

- Pinpoint channels that reach underserved communities

- Leverage cutting-edge technology to address real customer needs