How it works

We simplify embedded insurance at every step, from product setup to claims, so you can focus on scaling your business.

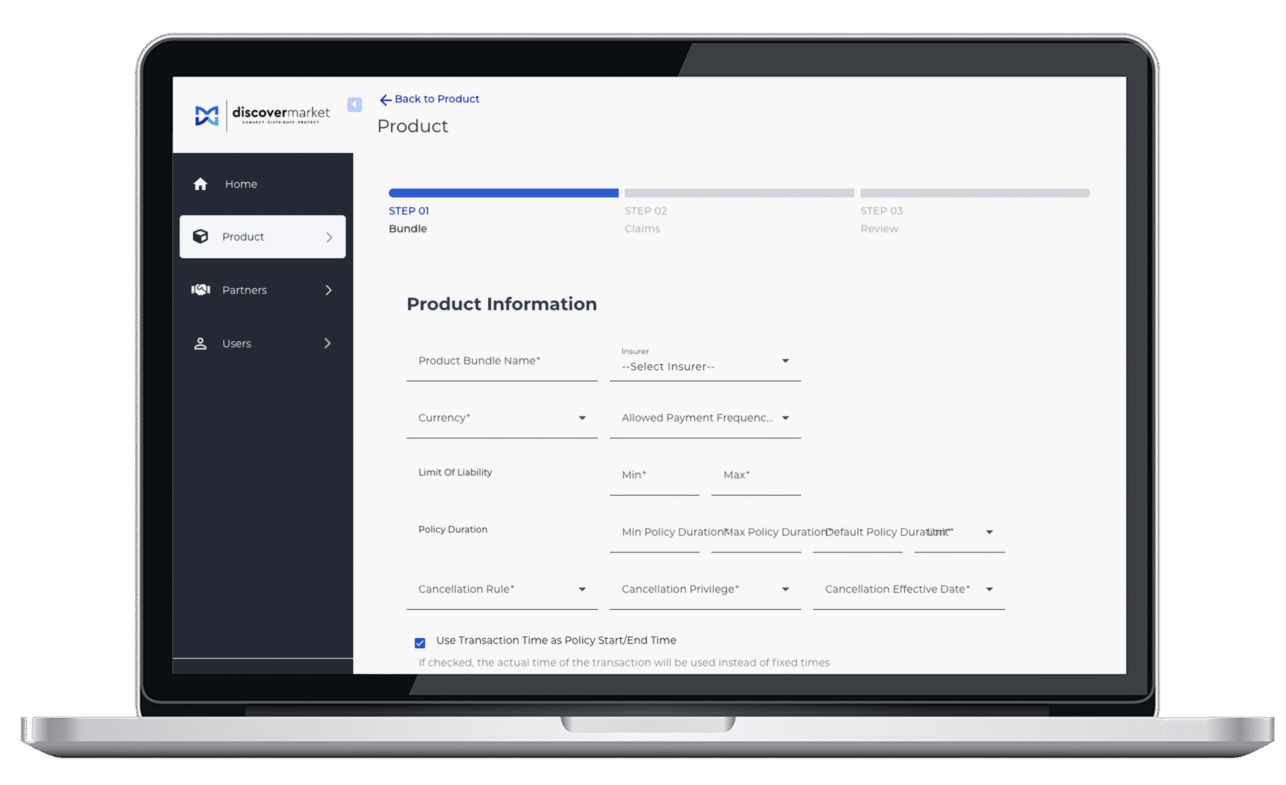

Build and Configure Products

Create and launch insurance offerings with ease

- Product Studio: Configure and deploy insurance solutions – no coding needed

- Product Library: Access ready-to-use product structures – quicker go-to-market

- Technology to Support Custom Pricing & Rules: Empower insurers to define and implement their own pricing and rule logic

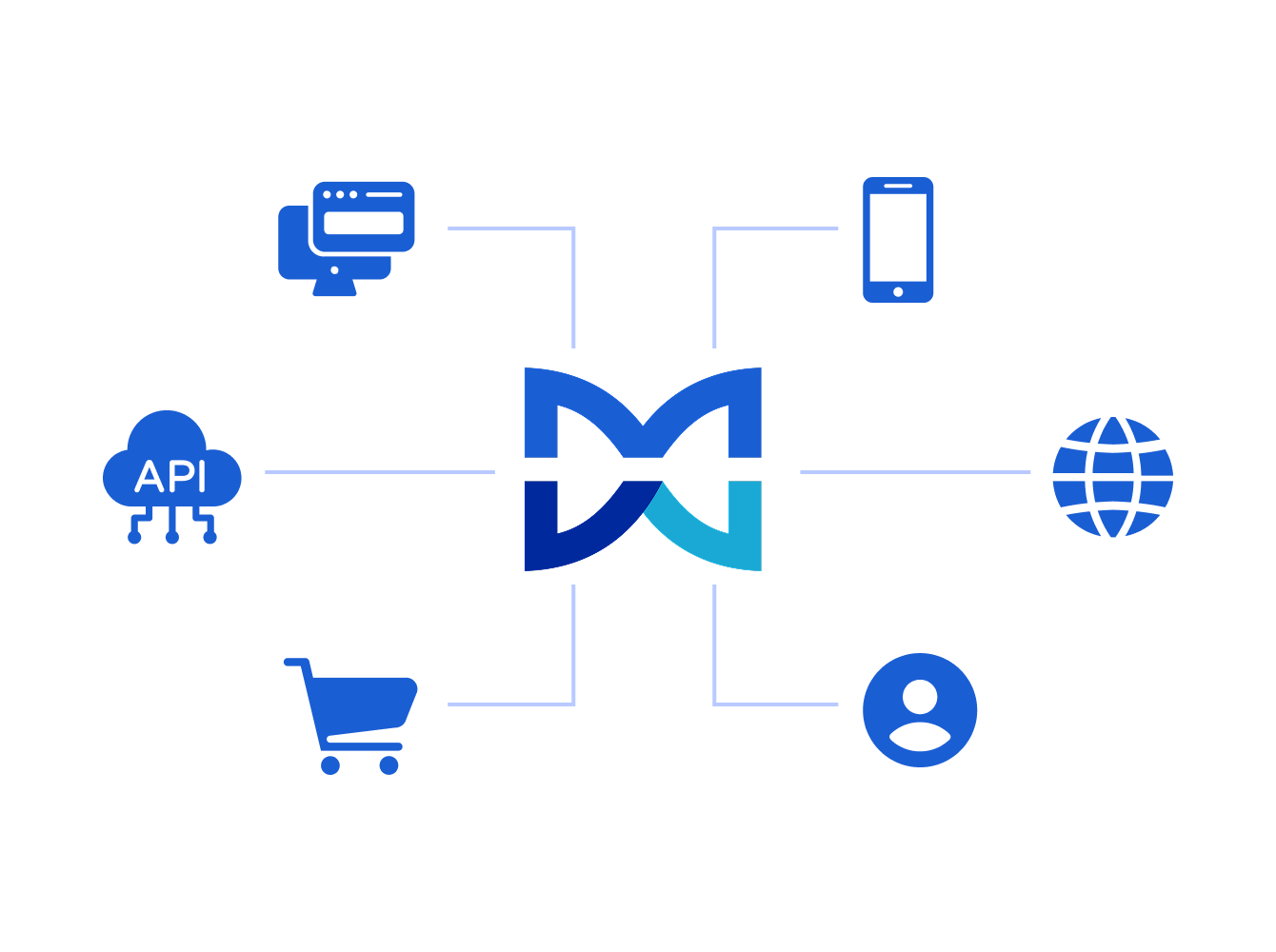

Seamless Product Distribution

Deliver a digital-first insurance experience across any channel

- Omnichannel Reach: Offer embedded, direct-to-consumer, or advisor-assisted experiences

- Flexible Integration: Deploy via API, SDK, widget, or microsite

- White-labelled Journeys: Customize the customer experience to match your brand

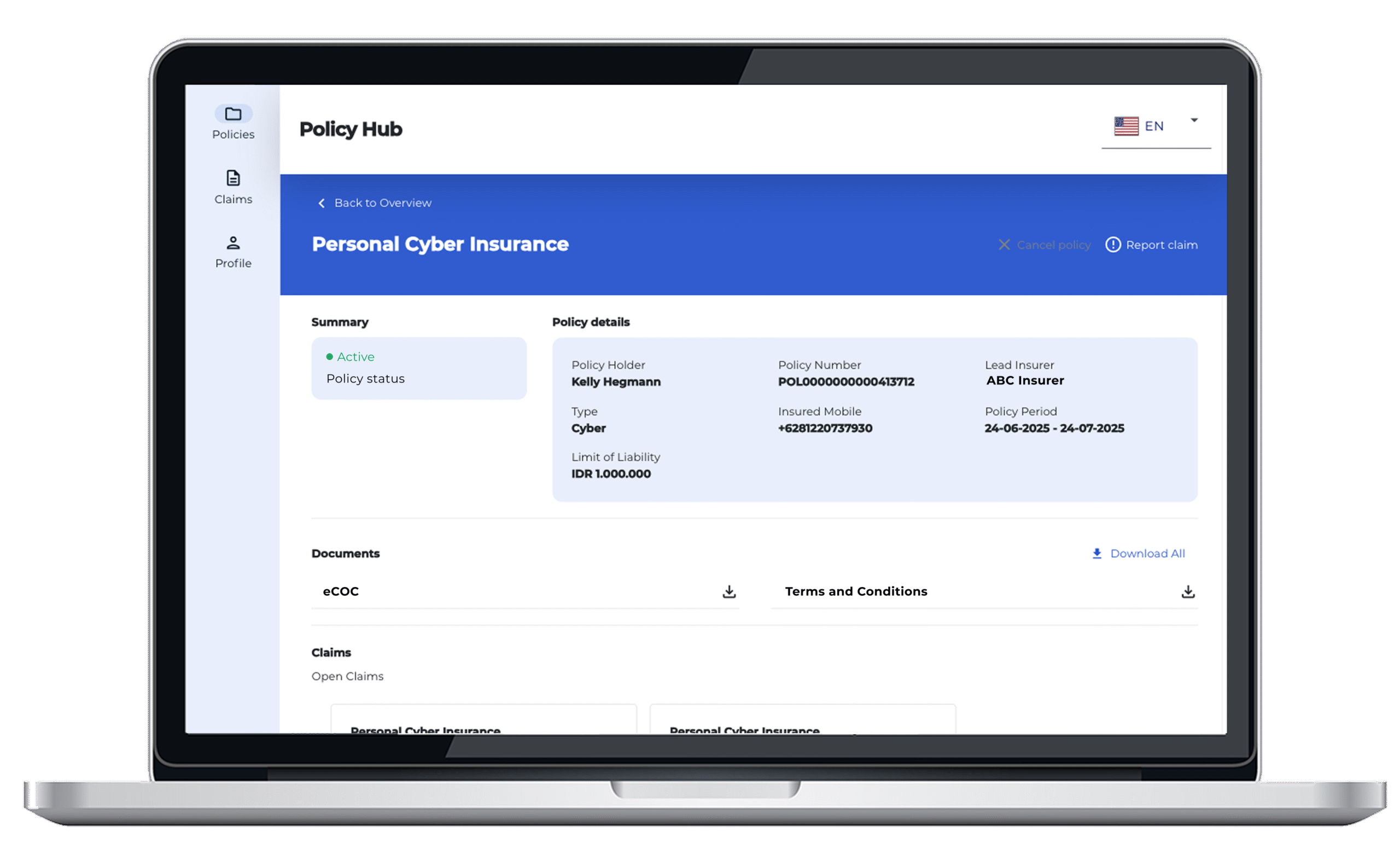

Efficient Policy Management

Streamline policy administration with automation and real-time controls

- Instant Issuance: Activate policies in real time

- Automated Alerts: Keep customers and stakeholders updated with real-time, automatic notifications

- Flexible Adjustments: Manage policy changes, cancellations and renewals effortlessly

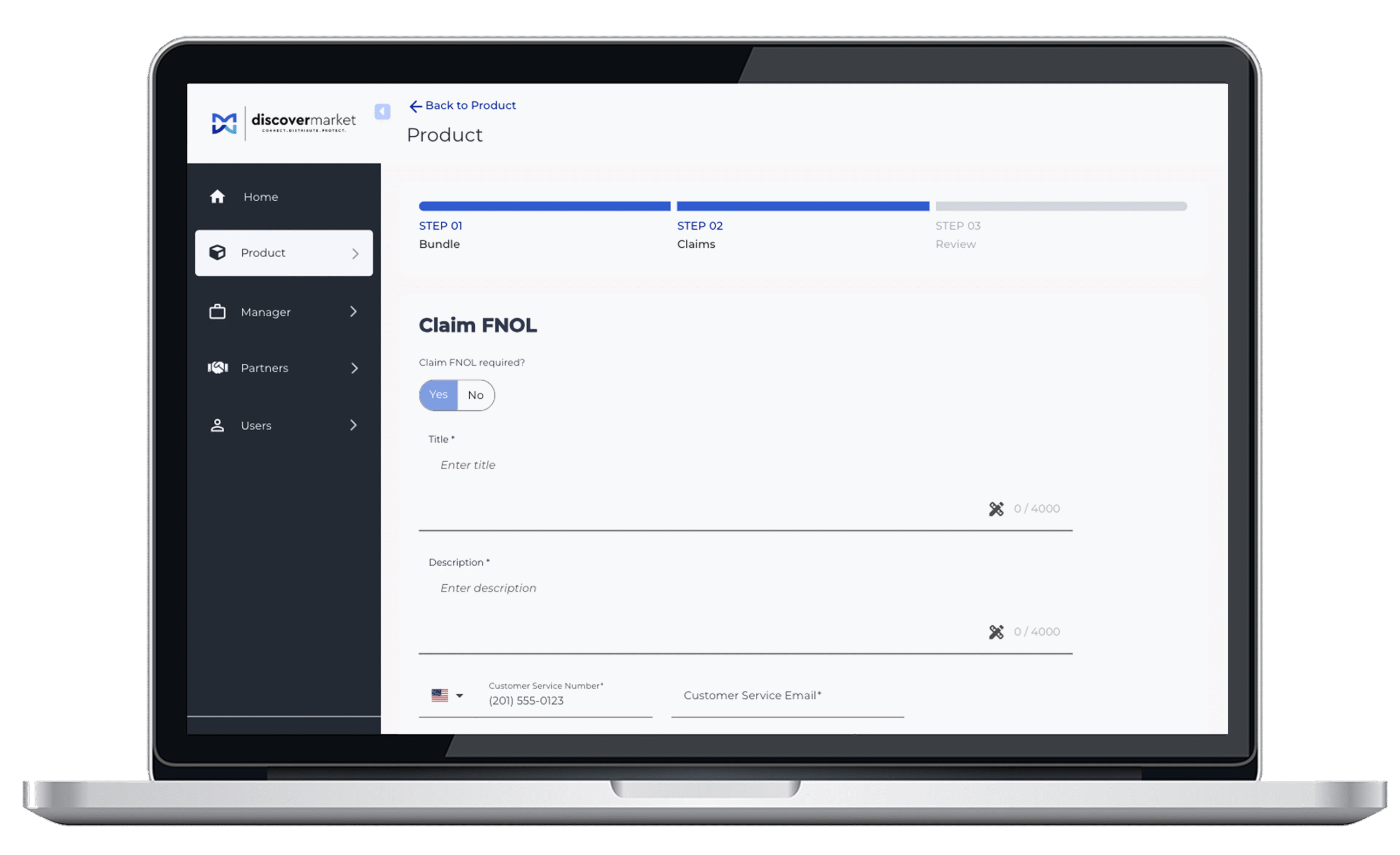

Smart Claims Handling

Enable seamless claims orchestration with automated workflows and real-time status updates

- Adaptive Claim Forms: Pre-configured workflows that connect insurers, partners and customers for smooth claims processing

- Secure Document Handling: Secure document encryption and storage

- Transparent Tracking: Provide real-time claims status visibility through dashboards and API integrations

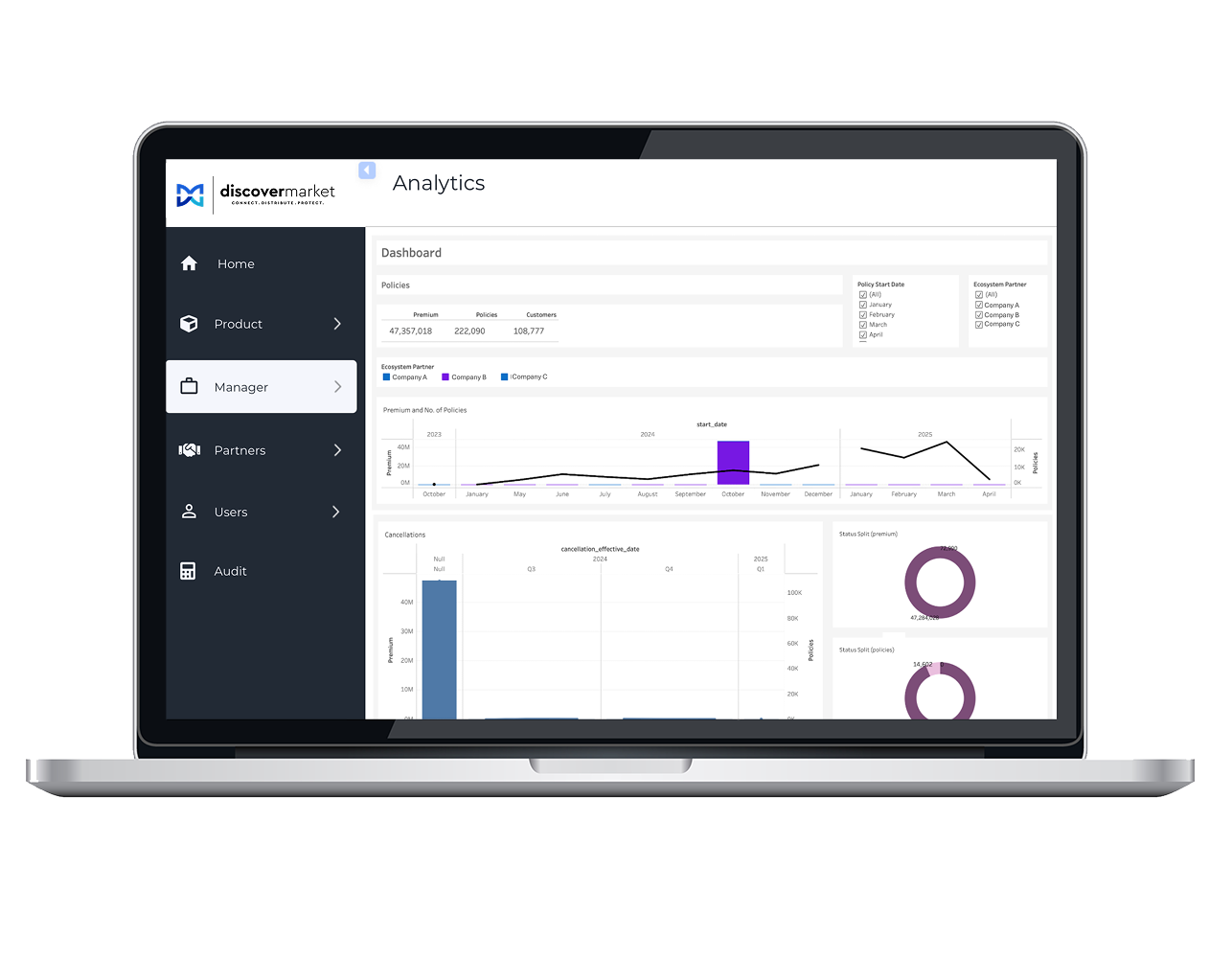

Data & Performance Insights

Make smarter decisions with real-time analytics

- Custom Dashboards: Track performance and engagement data

- Automated Reporting: Get insights on demand or scheduled reports

We also support parametric insurance models

-

Advanced Risk Modeling:

Using satellite imagery and AI analytics to equip insurers with the data needed to assess and price climate risks accurately

-

Customizable Parametric Triggers:

Tailored event-based insurance models designed to match specific business needs, from drought to extreme rainfall

-

Automated Claims & Instant Payouts:

Eliminating manual assessments by triggering payments based on real-time, verifiable data.

-

Multi-Peril Coverage:

Protection against diverse climate risks, including hurricanes, earthquakes, floods, and heatwaves

-

Seamless Integration & Scalability:

Designed to work across industries, embedding seamlessly into digital platforms and financial ecosystems.

-

Transparent & Objective Settlements:

Pre-agreed payout structures remove ambiguity, ensuring clarity and confidence in every policy

Your ecosystem, our technology

Launch Faster

Configure and deploy embedded insurance products with our no-code Product Studio. Bring products to market quickly with seamless integration.

Scale Smarter

Expand effortlessly across industries and markets. A single integration connects you to multiple partners and business lines, adapting as you grow your embedded portfolio.

Grow Stronger

Increase engagement and revenue with digital-first experience, automated workflows, real-time analytics and AI-driven processing.

Technical highlights